The Punjab government has introduced the CM Punjab Asaan Karobar Card, a program offering interest-free loans of up to PKR 1 million to support small and medium enterprises (SMEs). The card uses digital tools like mobile apps and POS systems to ensure transparency and convenience, making it easier for entrepreneurs to manage and sustain their businesses. This initiative aims to drive economic growth and empower small businesses across Punjab. Registering and logging in is easy through the official portal, akc.punjab.gov.pk.

Read More: CM Punjab Asaan Karobar Card Scheme 2025 Online Application

84 Billion Rupees Allocated for Aasaan Karobaar Scheme

The Punjab Chief Minister, Maryam Nawaz Sharif, has introduced the Aasaan Karobaar Finance Scheme and Aasaan Karobaar Card Scheme, the province’s largest business finance initiative. These programs aim to support young entrepreneurs, small business owners, and startups with interest-free loans. With a budget of 84 billion rupees, including 48 billion for the Aasaan Karobaar Card, these initiatives promote economic growth and job creation in Punjab, empowering individuals to contribute to the province’s development.

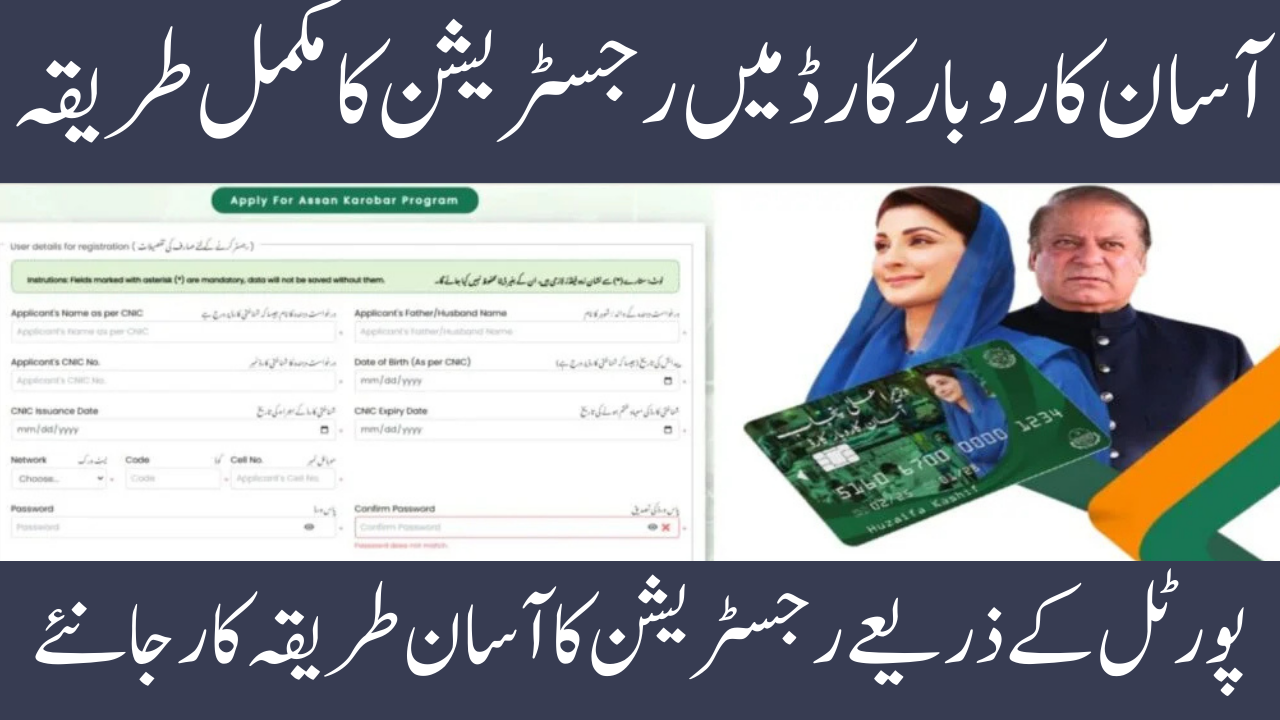

How the Asaan Karobar Card Application Process Works

Asaan Karobar Card Application Process:

• Visit the official website: akc.punjab.gov.pk.

• Fill out the online application form with personal and business details.

• Pay a non-refundable processing fee of PKR 500.

• Upload required documents: CNIC and proof of residence.

• Digital verification is conducted by authorized agencies.

• Approval issued for business-related transactions.

Table: CM Punjab Asaan Karobar Card Overview

| Feature | Details |

|---|---|

| Loan Amount | Interest-free loans up to PKR 1 million |

| Eligibility | Age: 21-57 yearsPunjab resident with CNICClean credit history |

| Application | Online via akc.punjab.gov.pkFee: PKR 500 |

| Usage | Vendor payments, utility bills, government fees, business expenses |

| Repayment | 3-month grace periodInstallments over 24 months |

| Key Benefits | transparent, digital process—revolving credit supports SMEs across Punjab |

| Helpline | Dial 1786 or visit akc.punjab.gov.pk |

How the Asaan Karobar Card Registration Process Works

Step 1: Access the Official Portal

Step 2: Complete the Registration Form

Personal Details for CNIC Registration:

• Enter full name, CNIC number, date of birth, and parents’/husbands’ names.

• Fill in CNIC issuance and expiry dates.

• Provide a valid mobile number and network.

• Ensure active mobile number for confirmation and updates.

• Create a strong password and confirm it.

Step 3: Review and Submit

Ensure accuracy by carefully checking all entered information, then click the “Register” button, and you’ll receive a confirmation message on your mobile phone.

How to Access Your Account on the Asaan Karobar Card

Login to Asaan Karobar Card Account

• Visit akc.punjab.gov.pk and click on the “Login” option.

• Provide a CNIC number and password.

• Access the dashboard to explore services under the Asaan Karobar Card program.

Advice for a Simple Login Process

Secure Online Accounts

• Ensure information matches registered details.

• Use stable internet for uninterrupted access.

• Maintain password security and avoid sharing.

About the Asaan Karobar Card Program

The CM Punjab Asaan Karobar Card is a financial support initiative for small businesses in Punjab, offering interest-free loans up to PKR 1 million. This program enables entrepreneurs to overcome financial barriers and focus on business growth. With revolving credit facilities and easy repayment options, it demonstrates the Punjab government’s commitment to entrepreneurship and economic growth.

Eligibility Criteria

Asaan Karobar Card Requirements

• Pakistani national and resident of Punjab.

• Age between 21-57 years.

• Possess a valid CNIC and registered mobile number.

• Own or plan a business in Punjab.

• Maintain a clean credit history.

• Pass psychometric and credit assessments.

• Register business with PRA/FBR within six months.

• Only one application is allowed per individual or business.

Loan Usage and Repayment Details

Asaan Karobar Card: Loan Usage and Repayment Flexibility

• First 50% of the loan accessible within six months post-approval.

• Three-month grace period before repayment.

• Monthly installments, starting with 5% of the outstanding balance.

• The second 50% is released upon satisfactory usage and timely repayment.

• Equal monthly installments (EMIs) over 24 months after the first year.

• Funds can be used for vendor payments, utility bills, government fees, and business expenses.

Charges and Fees

Asaan Karobar Card: Affordability for Entrepreneurs

• Annual Card Fee: PKR 25,000 + FED, deducted from loan limit.

• Additional Charges: Life assurance, card issuance, delivery costs.

• Late Payment Penalty: The bank’s policy applies for delayed installments.

Important Asaan Karobar Card Features

Interest-Free Loans Overview

• Borrow up to PKR 1 million without interest charges.

• Use funds for vendor payments, utility bills, and government fees via mobile apps and POS systems.

• Allow up to 25% cash withdrawal for business needs.

• Three-month grace period before repayment.

• Revolving credit facility: access and reuse funds within the first 12 months, followed by installment repayments over the next 24 months.

Benefits of the Asaan Karobar Card

Asaan Karobar Card Benefits for Small Businesses

• Provides easy access to funds for business growth.

• Ensures transparent and accountable fund usage.

• Offers financial relief for operational expenses and expansion needs.

• Supports small businesses across Punjab sectors.

• Offers a convenient, digital application process.

Helpline for Asaan Karobar Card

Asaan Karobar Card Assistance:

• Dial 1786 for queries and support.

• Services include registration, eligibility criteria, and the application process.

• Available during standard office hours.

• Visit https://akc.punjab.gov.pk for detailed information.

In Conclusion

The Punjab government has launched the CM Punjab Asaan Karobar Card, a program designed to support small entrepreneurs and drive economic growth in the province. The scheme provides interest-free loans and an easy application process, enabling entrepreneurs to overcome financial challenges and contribute to Punjab’s economic prosperity.